Some Known Questions About Stonewell Bookkeeping.

The Stonewell Bookkeeping Ideas

Table of ContentsA Biased View of Stonewell BookkeepingSome Of Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingThe Buzz on Stonewell BookkeepingThe Ultimate Guide To Stonewell Bookkeeping

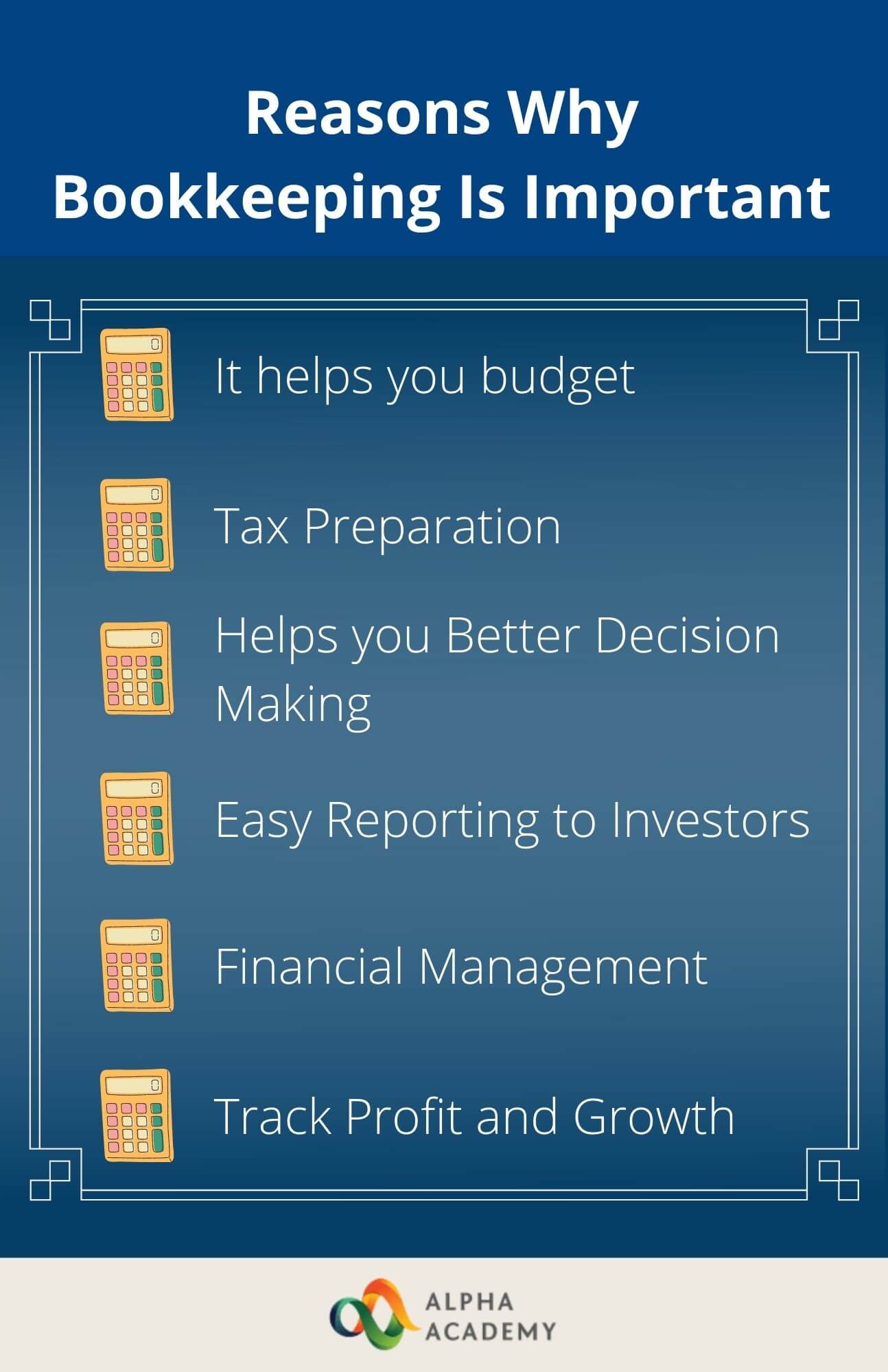

Every organization, from handmade towel manufacturers to game programmers to dining establishment chains, earns and invests money. You could not completely understand or even begin to fully value what a bookkeeper does.The history of accounting dates back to the start of commerce, around 2600 B.C. Early Babylonian and Mesopotamian accountants kept documents on clay tablets to maintain accounts of deals in remote cities. In colonial America, a Waste Book was commonly utilized in accounting. It contained a day-to-day diary of every purchase in the chronological order.

Local business may rely exclusively on an accountant at first, yet as they grow, having both experts aboard becomes progressively valuable. There are two primary kinds of accounting: single-entry and double-entry bookkeeping. documents one side of a monetary purchase, such as adding $100 to your cost account when you make a $100 acquisition with your bank card.

A Biased View of Stonewell Bookkeeping

includes taping economic purchases by hand or making use of spread sheets - business tax filing services. While low-cost, it's time consuming and susceptible to errors. uses tools like Sage Expense Management. These systems automatically sync with your debt card networks to give you bank card transaction data in real-time, and instantly code all information around expenses consisting of tasks, GL codes, places, and classifications.

In addition, some accountants additionally aid in maximizing pay-roll and billing generation for an organization. A successful bookkeeper needs the adhering to abilities: Precision is vital in economic recordkeeping.

They typically start with a macro perspective, such as an annual report or a revenue and loss statement, and after that drill into the details. Bookkeepers guarantee that vendor and client records are constantly approximately day, also as individuals and services modification. They may also require to collaborate with other departments to guarantee that everyone is using the same information.

Some Known Facts About Stonewell Bookkeeping.

Entering bills into the accounting system allows for exact preparation and decision-making. This helps companies obtain settlements faster and enhance cash circulation.

Entail interior auditors and compare their counts with the taped values. Accountants can function as consultants or in-house workers, and their compensation differs depending on the nature of their employment.

Freelancers usually charge by the hour but may provide flat-rate plans for particular jobs., the typical bookkeeper salary in the United States is. Remember that wages can vary depending on experience, education, location, and sector.

The 45-Second Trick For Stonewell Bookkeeping

Some of one of the most usual documentation that companies should submit to the federal government includesTransaction details Financial statementsTax compliance reportsCash circulation reportsIf your accounting is up to date all year, you can avoid a bunch of tension during tax obligation season. best franchises to own. Perseverance and focus to detail are crucial to much better accounting

Seasonality belongs of any job worldwide. For accountants, best franchises to own seasonality means durations when settlements come flying in via the roof covering, where having outstanding job can end up being a serious blocker. It becomes critical to prepare for these moments beforehand and to finish any type of backlog prior to the pressure duration hits.

Getting My Stonewell Bookkeeping To Work

Preventing this will certainly lower the threat of setting off an IRS audit as it supplies an exact representation of your financial resources. Some usual to keep your personal and organization finances different areUsing an organization bank card for all your business expensesHaving separate checking accountsKeeping invoices for individual and overhead different Visualize a world where your bookkeeping is done for you.

These integrations are self-serve and require no coding. It can automatically import data such as employees, projects, groups, GL codes, divisions, work codes, expense codes, tax obligations, and a lot more, while exporting costs as expenses, journal entrances, or credit report card fees in real-time.

Think about the complying with suggestions: A bookkeeper who has actually collaborated with services in your market will much better recognize your certain requirements. Accreditations like those from AIPB or NACPB can be a sign of integrity and proficiency. Ask for references or examine on-line evaluations to ensure you're working with someone trusted. is a fantastic place to begin.